Finance/ Accounting/ Tax/ Audit

Foreign-owned businesses involve complex cross-border taxation questions for both business and personal tax matters. Be with Tannet, we’ll guide you through this confusing area of tax in China.

Our tax and accounting experts will optimize your financial accounts. We’ll ensure that you only pay the minimum amount of tax for your circumstances. Our accountants stay on top of changes to rules and regulations in China to ensure compliance with Chinese laws.

A brief Introduction to Tax

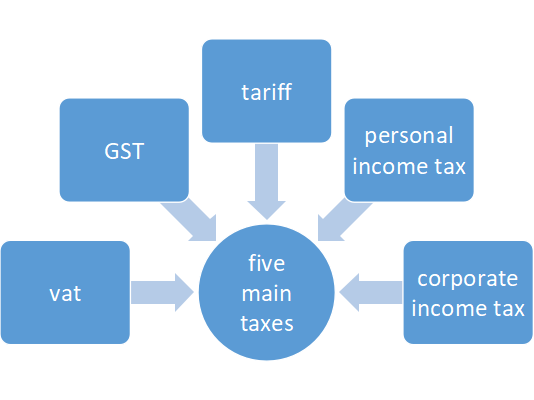

Like other countries in the world today, China adopts a compound tax system of multiple tax types. Under the current system, 18 types of tax are divided into five categories according to the object of taxation:

Income taxes: corporate income tax, individual income tax

Turnover taxes: value-added tax, consumption tax, tariff

Property taxes and act taxes: house property tax, deed tax, vehicle and vessel tax, stamp tax, city and town land use tax, land value increment tax etc

Resource taxes: resources tax

Special-purpose taxes: urban maintenance and construction tax, vehicle purchase tax, farmland conversion tax, tobacco tax, environmental protection tax. This chart will give an overview of the five important tax categories.

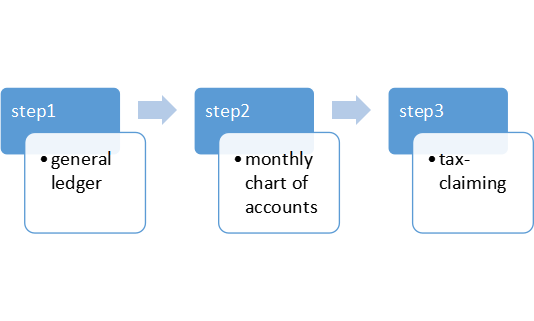

Finance & Accounting

Our qualified and registered accountants can keep your accounts in order. Our high standard of bookkeeping will enable you to monitor the performance of your business.

Audit Service

We conduct audits in accordance with the auditing standards issued by the authority. At the same time, we will evaluate the nature and special circumstances of each client’s business in order to conduct efficient audit services and accounting. The scope of our arranged audit services in China includes:

①Conduct a statutory audit

②Appraisal of capital value

③Conduct annual inspections of accounting and management systems

④Assess the judicial compliance of state-owned enterprises

⑤Set up reports and financial statements related to mergers, acquisitions, litigation and pension funds

⑥Conduct economic responsibility and efficiency research

Contact Us

If you have further inquires, please do not hesitate to contact Tannet at anytime, anywhere by simply visiting Tannet’s website, or calling Hong Kong hotline at 852-27826888 or China hotline at 86-755-82143512, or emailing to anitayao@citilinkia.com. You are also welcome to visit our office situated in 16/F, Taiyangdao Bldg 2020, Dongmen Rd South, Luohu, Shenzhen, China.